Subdivisions & Condo Buildings in 85249

Listed below are all the subdivisions and buildings in 85249 with median sale prices for each community. We've also included some recent sales in some of those communities.

Top Subdivisions/Buildings

We have calculated the top communities in 85249 based on the median sale prices of homes. The 85249 community with the highest average home sale price was Circle G at Ocotillo with an average of $3,075,000.

All Subdivisions/Condo Buildings in 85249

| Community | Median Price | |

|---|---|---|

Alamosa EstatesAlamosa Estates is a single-family home community in Chandler, Arizona, built between 2002 and 2003. It currently has 1 single family home for sale with a list price of $805,000. The homes range in size from 2,336 ft2 to 4,139 ft2. The HOA fees range from $110 to $187 per month. The average annual property tax for Alamosa Estates is $3,958.70. It is located in Maricopa County. |

925,000 | |

Anatolian Country EstatesAnatolian Country Estates is a single-family home community in Chandler, Arizona, built between 2013 and 2020. It currently has 1 single family home for sale with a list price of $1,900,000. The homes range in size from 3,075 ft2 to 5,576 ft2. The HOA fees range from $220 to $225 per month. The average annual property tax for Anatolian Country Estates is $4,886.25. It is located in Maricopa County. |

1,950,000 | |

AndorraAndorra is a single-family home community in Chandler, Arizona, built between 2005 and 2007. It currently has no homes for sale. The homes range in size from 2,834 ft2 to 4,621 ft2. The HOA fees range from $211 to $225 per month. The average annual property tax for Andorra is $4,960.13. It is located in Maricopa County. |

965,000 | |

Arizona CountryArizona Country is a single-family home community in Chandler, Arizona, built between 2002 and 2004. It currently has 1 single family home for sale with a list price of $899,900. The homes range in size from 2,547 ft2 to 3,922 ft2. The HOA fees range from $135 to $175 per month. The average annual property tax for Arizona Country is $4,060.08. It is located in Maricopa County. |

965,000 | |

Arizona EstatesArizona Estates is a single-family home community in Chandler, Arizona, built in 2000. It currently has 2 single family homes for sale with an average list price of $657,500. The homes range in size from 1,640 ft2 to 3,157 ft2. The HOA fees range from $63 to $72 per month. The average annual property tax for Arizona Estates is $2,094.12. It is located in Maricopa County. |

600,000 | |

Arizona ImpressionsArizona Impressions is a single-family home community in Chandler, Arizona, built between 1999 and 2000. It currently has no homes for sale. The homes range in size from 1,159 ft2 to 2,341 ft2. The HOA fees range from $63 to $79 per month. The average annual property tax for Arizona Impressions is $1,270.78. It is located in Maricopa County. |

||

Artesian RanchArtesian Ranch is a single-family home community in Chandler, Arizona, built between 2008 and 2016. It currently has 1 single family home for sale with a list price of $759,000. The homes range in size from 2,198 ft2 to 4,096 ft2. The HOA fees range from $60 to $86 per month. The average annual property tax for Artesian Ranch is $3,033.50. It is located in Maricopa County. |

||

|

Asher PointeAsher Pointe is a single-family home community in Chandler, Arizona, built between 2021 and 2023 by Lennar. It currently has 2 single family homes for sale with an average list price of $772,450. The homes range in size from 1,797 ft2 to 3,024 ft2. The HOA fees range from $142 to $200 per month. The average annual property tax for Asher Pointe is $933.20. It is located in Maricopa County. |

842,000 |

Autumn ParkAutumn Park in Chandler, AZ, boasts a vibrant array of modern amenities designed for an active and connected lifestyle, including a state-of-the-art fitness center with yoga studios and cardio equipment, expansive green spaces with walking trails and picnic areas, a sparkling community pool complete with cabanas and a splash pad for families, and a clubhouse hosting regular events like movie nights and social gatherings. Residents can easily venture out to nearby hotspots such as the lively Downtown Chandler district for boutique shopping and live music at venues like the Chandler Center for the Arts, or enjoy diverse dining options at spots like SanTan Brewing Company for craft beers and pub fare, The Perch Brewery with its rooftop views and exotic bird aviaries, or Hash Kitchen for inventive brunch creations. For outdoor enthusiasts, the area offers exploration at Veterans Oasis Park with its fishing lake and hiking paths, while thrill-seekers might head to Rawhide Western Town for Wild West shows and events. Essential health services are conveniently accessible, including facilities like Banner Health Center for primary Autumn Park is a single-family home community in Chandler, Arizona, built between 2013 and 2016. It currently has 2 single family homes for sale with an average list price of $795,000. The homes range in size from 2,308 ft2 to 4,010 ft2. The HOA fees range from $110 to $125 per month. The average annual property tax for Autumn Park is $3,210.58. It is located in Maricopa County. |

665,000 | |

Avian MeadowsAvian Meadows is a single-family home community in Chandler, Arizona, built between 2013 and 2017. It currently has 1 single family home for sale with a list price of $1,049,900. The homes range in size from 1,999 ft2 to 4,566 ft2. The HOA fees range from $79 to $106 per month. The average annual property tax for Avian Meadows is $3,043.48. It is located in Maricopa County. |

880,000 | |

Avian TrailsAvian Trails is a single-family home community in Chandler, Arizona, built between 2010 and 2013. It currently has 2 single family homes for sale with an average list price of $959,450. The homes range in size from 2,882 ft2 to 4,772 ft2. The HOA fees range from $60 to $88 per month. The average annual property tax for Avian Trails is $3,969.16. It is located in Maricopa County. |

885,000 | |

BarcelonaBarcelona is a single-family home community in Chandler, Arizona, built between 2012 and 2014. It currently has 2 single family homes for sale with an average list price of $1,012,250. The homes range in size from 2,742 ft2 to 3,216 ft2. The HOA fees range from $225 to $235 per month. The average annual property tax for Barcelona is $4,051.67. It is located in Maricopa County. |

925,000 | |

|

BarringtonBarrington is a single-family home community in Chandler, Arizona, built between 2001 and 2002. It currently has 1 single family home for sale with a list price of $959,990. The homes range in size from 3,825 ft2 to 5,450 ft2. The HOA fees range from $112 to $142 per month. The average annual property tax for Barrington is $3,978.38. It is located in Maricopa County. |

935,000 |

Bela Flor at RiggsBela Flor at Riggs is a single-family home community in Chandler, Arizona, built between 2003 and 2025. It currently has 1 single family home for sale with a list price of $2,625,000. The homes range in size from 1,149 ft2 to 5,376 ft2. The HOA fees range from $120 to $214 per month. The average annual property tax for Bela Flor at Riggs is $5,794.57. It is located in Maricopa County. |

1,865,000 | |

Bellaza IIBellaza II is a single-family home community in Chandler, Arizona, built between 2019 and 2021. It currently has no homes for sale. The homes range in size from 2,909 ft2 to 3,728 ft2. The HOA fees range from $189 to $189 per month. The average annual property tax for Bellaza II is $3,703.27. It is located in Maricopa County. |

1,093,750 | |

Brooks RanchBrooks Ranch is a single-family home community in Chandler, Arizona, built between 2003 and 2005. It currently has 2 single family homes for sale with an average list price of $875,000. The homes range in size from 2,241 ft2 to 4,712 ft2. The HOA fees range from $96 to $113 per month. The average annual property tax for Brooks Ranch is $3,171.38. It is located in Maricopa County. |

804,000 | |

CalabriaCalabria is a single-family home community in Chandler, Arizona, built between 2015 and 2017. It currently has no homes for sale. The homes range in size from 2,294 ft2 to 3,922 ft2. The HOA fees range from $111 to $142 per month. The average annual property tax for Calabria is $2,814.55. It is located in Maricopa County. |

820,000 | |

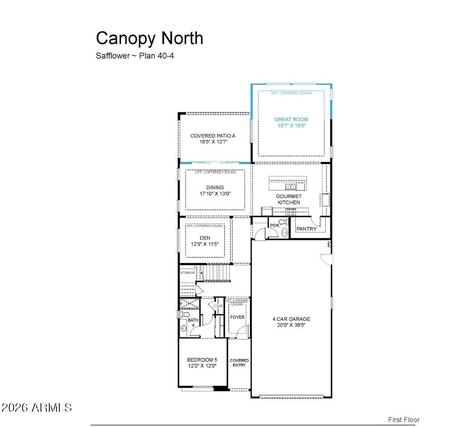

CanopyThis subdivision is also known as Berge Ranch. Canopy is a single-family home community in Chandler, Arizona, built between 2020 and 2023 by Tri Pointe Homes. It currently has 2 single family homes for sale with an average list price of $1,325,000. The homes range in size from 2,434 ft2 to 3,891 ft2. The HOA fees range from $20 to $140 per month. The average annual property tax for Canopy is $1,568.33. It is located in Maricopa County. |

1,222,500 | |

Cantabria ShoresCantabria Shores is a townhouse community in Chandler, Arizona, built in 1998. It currently has 4 townhouses for sale with an average list price of $439,800. The homes range in size from 1,188 ft2 to 2,379 ft2. The HOA fees range from $69 to $369 per month. The average annual property tax for Cantabria Shores is $2,787.34. It is located in Maricopa County. |

||

Canyon OaksCanyon Oaks is a single-family home community in Chandler, Arizona, built between 2003 and 2004. It currently has 1 single family home for sale with a list price of $425,000. The homes range in size from 1,220 ft2 to 1,708 ft2. The HOA fees range from $136 to $193 per month. The average annual property tax for Canyon Oaks is $1,521.50. It is located in Maricopa County. |

||

Canyon Oaks EstatesCanyon Oaks Estates is a single-family home community in Chandler, Arizona, built between 2000 and 2024. It currently has 4 single family homes for sale with an average list price of $618,750 and 1 lot for sale with a list price of $295,000. The homes range in size from 1,220 ft2 to 4,106 ft2. The HOA fees range from $29 to $187 per month. The average annual property tax for Canyon Oaks Estates is $2,437.00. It is located in Maricopa County. |

||

Carino EstatesCarino Estates is a single-family home community in Chandler, Arizona, built between 1998 and 2015. It currently has 6 single family homes for sale with an average list price of $684,816.67. The homes range in size from 1,457 ft2 to 3,340 ft2. The HOA fees range from $50 to $123 per month. The average annual property tax for Carino Estates is $2,835.65. It is located in Maricopa County. |

||

Chandler Heights CitrusResidents can easily access nearby attractions like the San Tan Mountain Regional Park for invigorating hikes and nature exploration, or enjoy family-friendly outings at Schnepf Farms with its seasonal festivals and agritourism experiences. For dining options, spots such as Queen Creek Olive Mill offer delightful Mediterranean-inspired meals and olive oil tastings, while casual eateries like Joe's Farm Grill serve up fresh, farm-to-table burgers and salads. Adventure seekers might head to the nearby Golfland Sunsplash for water park thrills and mini-golf, and essential health services are conveniently available at facilities like Banner Ironwood Medical Center, ensuring quick access to comprehensive care including emergency services and specialized clinics. Chandler Heights Citrus is a single-family home community in Queen Creek, Arizona, built between 1930 and 2026. It currently has 27 single family homes for sale with an average list price of $1,190,948.07 and 4 lots for sale with an average list price of $453,225. The homes range in size from 864 ft2 to 5,004 ft2. The HOA fees range from $40 to $288 per month. The average annual property tax for Chandler Heights Citrus is $2,601.87. It is located in Maricopa County. |

||

Chandler Heights EstatesThis subdivision is also known as Heartland. Chandler Heights Estates is a single-family home community in Chandler, Arizona, built between 1999 and 2001. It currently has 1 single family home for sale with a list price of $729,900. The homes range in size from 1,778 ft2 to 3,382 ft2. The HOA fees range from $62 to $132 per month. The average annual property tax for Chandler Heights Estates is $2,707.23. It is located in Maricopa County. |

651,875 | |

Circle G at OcotilloBeyond the subdivision, residents can enjoy nearby dining spots like Postino for upscale wine and bruschetta pairings or Joyride Taco House for vibrant Mexican cuisine, while adventure seekers might head to Topgolf for high-tech golfing entertainment or explore the Riparian Preserve at Water Ranch for birdwatching and nature hikes amid serene wetlands. For health and wellness, essential services are conveniently close, such as Banner Health Center offering comprehensive medical care and Dignity Health Urgent Care for prompt attention to everyday needs, making this community a perfect blend of modern comforts and accessible outings. Circle G at Ocotillo is a single-family home community in Gilbert, Arizona, built between 2003 and 2020. It currently has 1 single family home for sale with a list price of $3,000,000 and 1 lot for sale with a list price of $999,999. The homes range in size from 3,130 ft2 to 8,502 ft2. The HOA fees range from $57 to $112 per month. The average annual property tax for Circle G at Ocotillo is $8,311.29. It is located in Maricopa County. |

3,075,000 | |

Circle G at Riggs Homestead RanchThis subdivision is also known as Circle G Ranches. Circle G at Riggs Homestead Ranch is a single-family home community in Chandler, Arizona, built between 1996 and 2016. It currently has 3 single family homes for sale with an average list price of $1,674,999.67. The homes range in size from 3,226 ft2 to 6,632 ft2. The HOA fees range from $40 to $147 per month. The average annual property tax for Circle G at Riggs Homestead Ranch is $7,593.23. It is located in Maricopa County. |

1,800,000 | |

Circle G at Silver CreekJust a short distance away, dining options abound with spots like Joe's Real BBQ for mouthwatering smoked meats and The Coffee Shop for cozy breakfast vibes, while adventure seekers can head to Hale Centre Theatre for live performances or explore the vibrant Freestone District Skate Park for some thrilling action. For nature lovers, the nearby Riparian Preserve offers birdwatching and scenic trails, and essential health services are conveniently accessible at facilities such as Mercy Gilbert Medical Center, ensuring peace of mind for everyday wellness needs. Circle G at Silver Creek is a single-family home community in Gilbert, Arizona, built between 2007 and 2018. It currently has no homes for sale. The homes range in size from 4,941 ft2 to 8,925 ft2. The HOA fees range from $62 to $117 per month. The average annual property tax for Circle G at Silver Creek is $9,034.63. It is located in Maricopa County. |

||

Clemente RanchClemente Ranch is a single-family home community in Chandler, Arizona, built between 1994 and 2002. It currently has 1 single family home for sale with a list price of $474,900. The homes range in size from 1,233 ft2 to 3,090 ft2. The HOA fees range from $31 to $99 per month. The average annual property tax for Clemente Ranch is $2,247.91. It is located in Maricopa County. |

||

Colonia CoronitaColonia Coronita is a single-family home and townhouse community in Chandler, Arizona, built between 1978 and 1985. It currently has 3 single family homes for sale with an average list price of $451,666.67 and 2 townhouses for sale with an average list price of $276,950. The homes range in size from 831 ft2 to 1,801 ft2. The HOA fees range from $190 to $245 per month. The average annual property tax for Colonia Coronita is $1,061.07. It is located in Maricopa County. |

||

|

Cooper CommonsCooper Commons is a single-family home community in Chandler, Arizona, built between 1999 and 2007. It currently has 18 single family homes for sale with an average list price of $528,500. The homes range in size from 1,161 ft2 to 4,634 ft2. The HOA fees range from $26 to $146 per month. The average annual property tax for Cooper Commons is $1,879.37. It is located in Maricopa County. |

430,000 |

Cooper CornersCooper Corners is a single-family home community in Chandler, Arizona, built between 2003 and 2005. It currently has 2 single family homes for sale with an average list price of $736,944. The homes range in size from 1,723 ft2 to 4,315 ft2. The HOA fees range from $25 to $100 per month. The average annual property tax for Cooper Corners is $3,329.32. It is located in Maricopa County. |

735,000 | |

Cooper Country EstatesCooper Country Estates is a single-family home community in Chandler, Arizona, built between 2003 and 2004. It currently has 1 single family home for sale with a list price of $999,999. The homes range in size from 2,739 ft2 to 4,809 ft2. The HOA fees range from $108 to $125 per month. The average annual property tax for Cooper Country Estates is $3,936.38. It is located in Maricopa County. |

800,000 | |

Cooper GreensCooper Greens is a single-family home community in Chandler, Arizona, built between 2002 and 2004. It currently has no homes for sale. The homes range in size from 1,952 ft2 to 3,597 ft2. The HOA fees range from $60 to $95 per month. The average annual property tax for Cooper Greens is $2,952.38. It is located in Maricopa County. |

||

CordovaCordova is a single-family home community in Gilbert, Arizona, built in 2004. It currently has no homes for sale. The homes have an average size of 5,647 ft2. The HOA fees range from $170 to $170 per month. The average annual property tax for Cordova is $8,794. It is located in Maricopa County. |

||

CortinaCortina is a single-family home community in Queen Creek, Arizona, built between 2002 and 2022. It currently has 13 single family homes for sale with an average list price of $654,600. The homes range in size from 1,567 ft2 to 4,700 ft2. The HOA fees range from $75 to $250 per month. The average annual property tax for Cortina is $2,444.14. It is located in Maricopa County. |

||

Country Lane EstatesCountry Lane Estates is a single-family home community in Chandler, Arizona, built between 2007 and 2014. It currently has no homes for sale. The homes range in size from 2,985 ft2 to 4,263 ft2. The HOA fees range from $127 to $140 per month. The average annual property tax for Country Lane Estates is $6,175.33. It is located in Maricopa County. |

||

Countryside EstatesCountryside Estates is a single-family home community in Chandler, Arizona, built between 2002 and 2005. It currently has 1 single family home for sale with a list price of $875,000. The homes range in size from 2,691 ft2 to 4,468 ft2. The HOA fees range from $99 to $118 per month. The average annual property tax for Countryside Estates is $3,886.20. It is located in Maricopa County. |

816,000 | |

Creekwood RanchCreekwood Ranch is a single-family home community in Chandler, Arizona, built between 2001 and 2002. It currently has 1 single family home for sale with a list price of $595,000. The homes range in size from 1,999 ft2 to 3,119 ft2. The HOA fees range from $63 to $73 per month. The average annual property tax for Creekwood Ranch is $2,785.27. It is located in Maricopa County. |

680,000 | |

Double R MeadowsDouble R Meadows is a single-family home community in Gilbert, Arizona, built between 2005 and 2009. It currently has no homes for sale. The homes range in size from 3,769 ft2 to 5,350 ft2. The HOA fees range from $50 to $60 per month. The average annual property tax for Double R Meadows is $7,609.33. It is located in Maricopa County. |

||

Eagle Glen IEagle Glen I is a single-family home community in Chandler, Arizona, built between 2006 and 2009. It currently has no homes for sale. The homes range in size from 1,964 ft2 to 3,430 ft2. The HOA fees range from $66 to $73 per month. The average annual property tax for Eagle Glen I is $2,957. It is located in Maricopa County. |

||

Earnhardt RanchEarnhardt Ranch is a single-family home community in Chandler, Arizona, built between 2024 and 2025 by Blandford Homes. It currently has 1 single family home for sale with a list price of $1,250,000. The homes range in size from 2,462 ft2 to 3,611 ft2. The HOA fees range from $219 to $229 per month. The average annual property tax for Earnhardt Ranch is $2,929.57. It is located in Maricopa County. |

962,048 | |

Echelon at OcotilloEchelon at Ocotillo is a single-family home community in the Ocotillo neighborhood of Chandler, Arizona, built between 2016 and 2018. It currently has 1 single family home for sale with a list price of $1,250,000. The homes range in size from 2,404 ft2 to 3,757 ft2. The HOA fees range from $145 to $195 per month. The average annual property tax for Echelon at Ocotillo is $3,110.37. It is located in Maricopa County. |

||

Estates at McQueenEstates at McQueen is a single-family home community in Chandler, Arizona, built between 2004 and 2014. It currently has 1 lot for sale with a list price of $525,000. The homes range in size from 3,922 ft2 to 5,381 ft2. The HOA fees range from $135 to $210 per month. The average annual property tax for Estates at McQueen is $6,335.33. It is located in Maricopa County. |

1,337,500 | |

Estates at San Tan VistaEstates at San Tan Vista is a single-family home community in Chandler, Arizona, built between 2005 and 2007. It currently has 3 single family homes for sale with an average list price of $1,281,000. The homes range in size from 3,477 ft2 to 5,411 ft2. The HOA fees range from $133 to $159 per month. The average annual property tax for Estates at San Tan Vista is $6,203.29. It is located in Maricopa County. |

1,085,000 | |

Evans RanchJust a short distance away, residents can savor diverse dining options at spots like Postino for wine and bruschetta or O.H.S.O. Brewery for craft beers and pub fare, while adventure seekers might enjoy hiking at the nearby Usery Mountain Regional Park or catching a show at the Hale Centre Theatre. For exploration, the Gilbert Farmers Market offers fresh local produce and artisanal goods on weekends, and essential health services are conveniently accessible at facilities like Dignity Health Urgent Care or the comprehensive Banner MD Anderson Cancer Center, ensuring peace of mind for everyday wellness needs. Evans Ranch is a single-family home community in Gilbert, Arizona, built between 2007 and 2013. It currently has 3 single family homes for sale with an average list price of $619,966.67. The homes range in size from 1,460 ft2 to 3,758 ft2. The HOA fees range from $67 to $100 per month. The average annual property tax for Evans Ranch is $2,457.67. It is located in Maricopa County. |

||

|

Falcon EstatesFalcon Estates is a single-family home community in Chandler, Arizona, built between 2004 and 2005. It currently has no homes for sale. The homes range in size from 4,472 ft2 to 7,432 ft2. The HOA fees range from $190 to $225 per month. The average annual property tax for Falcon Estates is $6,499. It is located in Maricopa County. |

1,325,000 |

Felty FarmsResidents can easily access nearby dining spots like Joe's Farm Grill for farm-to-table burgers or Postino for wine and bruschetta boards, while adventure seekers might enjoy hiking trails at the nearby Usery Mountain Regional Park or catching a show at the Hale Centre Theatre. For exploration, the Gilbert Historical Museum offers a glimpse into local heritage, and essential health services are conveniently close with facilities like Dignity Health Urgent Care providing prompt medical attention. New additions to the area include a vibrant farmers market held weekly in the subdivision's central pavilion, fostering community connections, and electric vehicle charging stations integrated into the neighborhood's parking areas to support eco-friendly lifestyles. Felty Farms is a single-family home community in Gilbert, Arizona, built between 2006 and 2023. It currently has 1 single family home for sale with a list price of $760,000. The homes range in size from 1,842 ft2 to 4,209 ft2. The HOA fees range from $70 to $163 per month. The average annual property tax for Felty Farms is $2,763.32. It is located in Maricopa County. |

||

Fieldstone EstatesFieldstone Estates is a single-family home community in Chandler, Arizona, built between 2003 and 2004. It currently has no homes for sale. The homes range in size from 2,231 ft2 to 4,019 ft2. The HOA fees range from $150 to $190 per month. The average annual property tax for Fieldstone Estates is $4,531.54. It is located in Maricopa County. |

986,000 | |

FinesterraFinesterra is a single-family home community in Chandler, Arizona, built between 2005 and 2008. It currently has no homes for sale. The homes range in size from 3,164 ft2 to 4,922 ft2. The HOA fees range from $195 to $235 per month. The average annual property tax for Finesterra is $5,256.40. It is located in Maricopa County. |

970,500 | |

FinisterraFinisterra is a single-family home community in Chandler, Arizona, built between 2014 and 2016. It currently has 1 single family home for sale with a list price of $800,000. The homes range in size from 2,284 ft2 to 4,502 ft2. The HOA fees range from $120 to $150 per month. The average annual property tax for Finisterra is $2,813.55. It is located in Maricopa County. |

819,250 | |

Fonte Al SoleFonte Al Sole is a single-family home community in Chandler, Arizona, built between 2003 and 2005. It currently has 2 single family homes for sale with an average list price of $957,000. The homes range in size from 2,894 ft2 to 4,844 ft2. The HOA fees range from $61 to $108 per month. The average annual property tax for Fonte Al Sole is $4,009.38. It is located in Maricopa County. |

840,000 | |

Fox CrossingFox Crossing is a single-family home community in Chandler, Arizona, built between 1998 and 2001. It currently has 8 single family homes for sale with an average list price of $678,475. The homes range in size from 1,674 ft2 to 4,312 ft2. The HOA fees range from $35 to $94 per month. The average annual property tax for Fox Crossing is $2,977.71. It is located in Maricopa County. |

||

Geneva EstatesGeneva Estates is a single-family home community in Chandler, Arizona, built between 2006 and 2010. It currently has 1 single family home for sale with a list price of $750,000. The homes range in size from 2,438 ft2 to 4,352 ft2. The HOA fees range from $97 to $127 per month. The average annual property tax for Geneva Estates is $4,479.82. It is located in Maricopa County. |

920,000 | |

Gila Butte EstatesGila Butte Estates is a single-family home community in Chandler, Arizona, built between 1978 and 1993. It currently has 1 single family home for sale with a list price of $2,300,000. The homes range in size from 1,912 ft2 to 3,633 ft2. The average annual property tax for Gila Butte Estates is $4,597. It is located in Maricopa County. |

||

Hamilton ParkHamilton Park is a single-family home community in Chandler, Arizona, built between 2006 and 2007. It currently has no homes for sale. The homes range in size from 1,534 ft2 to 2,205 ft2. The HOA fees range from $99 to $143 per month. The average annual property tax for Hamilton Park is $1,870.67. It is located in Maricopa County. |

||

Hawthorn ManorHawthorn Manor is a single-family home community in Chandler, Arizona, built between 2009 and 2019. It currently has 1 single family home for sale with a list price of $1,425,000. The homes range in size from 3,552 ft2 to 8,415 ft2. The HOA fees range from $125 to $170 per month. The average annual property tax for Hawthorn Manor is $3,969.57. It is located in Maricopa County. |

2,800,000 | |

Hidden ValleyHidden Valley is a single-family home community in Maricopa, Arizona, built between 1974 and 2026 by Centex. It currently has 23 single family homes for sale with an average list price of $490,439.13 and 99 lots for sale with an average list price of $149,968.66. The homes range in size from 864 ft2 to 5,347 ft2. The HOA fees range from $47 to $102 per month. The average annual property tax for Hidden Valley is $1,466.76. It is located in Pinal County. |

||

Holliday FarmsJust a short distance away, food enthusiasts can savor farm-to-table delights at Joe's Farm Grill or indulge in craft brews at O.H.S.O. Brewery, while adventure seekers might head to the Riparian Preserve at Water Ranch for birdwatching and nature hikes, or explore the thrilling slides and wave pools at Big Surf Waterpark. For family fun, the Gilbert Regional Park provides playgrounds and sports fields, and essential health services are conveniently accessible at nearby spots like Banner Gateway Medical Center, ensuring peace of mind for all who call this welcoming community home. Holliday Farms is a single-family home community in Gilbert, Arizona, built between 1996 and 1999. It currently has 2 single family homes for sale with an average list price of $674,950. The homes range in size from 1,528 ft2 to 3,275 ft2. The HOA fees range from $37 to $50 per month. The average annual property tax for Holliday Farms is $1,966.12. It is located in Maricopa County. |

||

Ironwood VistasIronwood Vistas is a single-family home community in Chandler, Arizona, built between 2000 and 2001. It currently has 2 single family homes for sale with an average list price of $410,000. The homes range in size from 1,131 ft2 to 2,878 ft2. The HOA fees range from $133 to $160 per month. The average annual property tax for Ironwood Vistas is $1,773.95. It is located in Maricopa County. |

||

Jacaranda PlaceJacaranda Place is a single-family home community in Chandler, Arizona, built between 2015 and 2017. It currently has 1 single family home for sale with a list price of $1,350,000. The homes range in size from 3,395 ft2 to 4,200 ft2. The HOA fees range from $184 to $230 per month. The average annual property tax for Jacaranda Place is $4,034.44. It is located in Maricopa County. |

1,137,500 | |

Kerby EstatesKerby Estates is a single-family home community in Chandler, Arizona, built between 2003 and 2005. It currently has 4 single family homes for sale with an average list price of $796,975. The homes range in size from 2,178 ft2 to 4,221 ft2. The HOA fees range from $82 to $122 per month. The average annual property tax for Kerby Estates is $3,134.70. It is located in Maricopa County. |

750,000 | |

La PalomaLa Paloma is a single-family home community in Chandler, Arizona, built in 2005. It currently has no homes for sale. The homes range in size from 985 ft2 to 1,720 ft2. The HOA fees range from $133 to $155 per month. The average annual property tax for La Paloma is $1,417.19. It is located in Maricopa County. |

||

La ValenciaLa Valencia is a single-family home community in Chandler, Arizona, built between 2021 and 2023. It currently has 2 single family homes for sale with an average list price of $609,400. The homes range in size from 2,220 ft2 to 2,296 ft2. The HOA fees range from $130 to $140 per month. The average annual property tax for La Valencia is $1,405.15. It is located in Maricopa County. |

630,000 | |

Lagos VistosoLagos Vistoso is a single-family home community in Chandler, Arizona, built between 2003 and 2005. It currently has 2 single family homes for sale with an average list price of $652,500. The homes range in size from 1,379 ft2 to 3,527 ft2. The HOA fees range from $106 to $171 per month. The average annual property tax for Lagos Vistoso is $2,455.02. It is located in Maricopa County. |

537,500 | |

Lantana RanchLantana Ranch is a single-family home and townhouse community in Chandler, Arizona, built between 2001 and 2004. It currently has no homes for sale. The homes range in size from 1,580 ft2 to 3,405 ft2. The HOA fees range from $60 to $180 per month. The average annual property tax for Lantana Ranch is $2,175.85. It is located in Maricopa County. |

||

Layton LakesLayton Lakes is a single-family home and townhouse community in Chandler (Gilbert), Arizona, built between 2007 and 2023 by Lennar. It currently has 14 single family homes for sale with an average list price of $816,450 and 6 townhouses for sale with an average list price of $429,483.33. The homes range in size from 1,213 ft2 to 4,658 ft2. The HOA fees range from $40 to $516 per month. The average annual property tax for Layton Lakes is $2,638.52. It is located in Maricopa County. |

||

LucindaLucinda is a single-family home community in Chandler, Arizona, built between 2005 and 2019. It currently has no homes for sale. The homes range in size from 2,323 ft2 to 3,151 ft2. The HOA fees range from $145 to $150 per month. The average annual property tax for Lucinda is $2,774.80. It is located in Maricopa County. |

850,000 | |

MaderasMaderas is a single-family home community in Chandler, Arizona, built between 2016 and 2018. It currently has no homes for sale. The homes have an average size of 4,025 ft2. The HOA fees range from $270 to $271 per month. The average annual property tax for Maderas is $5,369.50. It is located in Maricopa County. |

||

Marbella At Valencia 2Marbella At Valencia 2 is a single-family home community in Chandler, Arizona, built between 2008 and 2012. It currently has 1 single family home for sale with a list price of $1,240,000. The homes range in size from 3,408 ft2 to 3,750 ft2. The HOA fees range from $211 to $235 per month. The average annual property tax for Marbella At Valencia 2 is $5,204.92. It is located in Maricopa County. |

975,000 | |

McQueen LakesMcQueen Lakes is a single-family home community in Chandler, Arizona, built between 2004 and 2006. It currently has no homes for sale. The homes range in size from 2,531 ft2 to 4,812 ft2. The HOA fees range from $138 to $160 per month. The average annual property tax for McQueen Lakes is $3,593.19. It is located in Maricopa County. |

912,050 | |

Mesquite Grove EstatesMesquite Grove Estates is a single-family home community in Chandler, Arizona, built between 2001 and 2004. It currently has 3 single family homes for sale with an average list price of $730,966.67. The homes range in size from 1,914 ft2 to 3,606 ft2. The HOA fees range from $105 to $174 per month. The average annual property tax for Mesquite Grove Estates is $3,555.98. It is located in Maricopa County. |

850,000 | |

Mission EstatesMission Estates is a single-family home community in Chandler, Arizona, built between 2018 and 2019. It currently has no homes for sale. The homes range in size from 3,201 ft2 to 3,899 ft2. The HOA fees range from $189 to $190 per month. The average annual property tax for Mission Estates is $3,546.80. It is located in Maricopa County. |

1,225,000 | |

Monarch at Symphony IIMonarch at Symphony II is a single-family home community in Chandler, Arizona, built between 2001 and 2003. It currently has 3 single family homes for sale with an average list price of $919,666.33. The homes range in size from 3,925 ft2 to 4,804 ft2. The HOA fees range from $113 to $150 per month. The average annual property tax for Monarch at Symphony II is $4,469.23. It is located in Maricopa County. |

998,000 | |

Monarch at Symphony IIIMonarch at Symphony III is a single-family home community in Chandler, Arizona, built between 2002 and 2003. It currently has no homes for sale. The homes range in size from 2,880 ft2 to 3,377 ft2. The HOA fees range from $66 to $108 per month. The average annual property tax for Monarch at Symphony III is $3,288.73. It is located in Maricopa County. |

735,000 | |

Montefino VillageMontefino Village is a single-family home community in Chandler, Arizona, built between 2000 and 2004. It currently has 2 single family homes for sale with an average list price of $540,000. The homes range in size from 1,311 ft2 to 2,712 ft2. The HOA fees range from $70 to $222 per month. The average annual property tax for Montefino Village is $2,467.71. It is located in Maricopa County. |

||

Nantucket VillageNantucket Village is a single-family home community in Chandler, Arizona, built between 2001 and 2002. It currently has no homes for sale. The homes range in size from 1,990 ft2 to 2,385 ft2. The HOA fees range from $54 to $58 per month. The average annual property tax for Nantucket Village is $1,989.67. It is located in Maricopa County. |

||

North BarringtonNorth Barrington is a single-family home community in Chandler, Arizona, built in 2004. It currently has 2 single family homes for sale with an average list price of $989,500. The homes range in size from 2,738 ft2 to 5,731 ft2. The HOA fees range from $145 to $175 per month. The average annual property tax for North Barrington is $4,535.33. It is located in Maricopa County. |

1,000,000 | |

Ocotillo Grove EstatesOcotillo Grove Estates is a subdivision in Chandler, Arizona. It currently has no homes for sale. It is located in Maricopa County. |

||

Ocotillo Grove EstatesOcotillo Grove Estates is a single-family home community in Gilbert, Arizona, built in 2004. It currently has no homes for sale. The homes range in size from 6,647 ft2 to 7,369 ft2. The HOA fees range from $180 to $324 per month. The average annual property tax for Ocotillo Grove Estates is $10,647.50. It is located in Maricopa County. |

||

|

Ocotillo LakesOcotillo Lakes is a single-family home community in the Ocotillo neighborhood of Chandler, Arizona, built between 1998 and 1999. It currently has 3 single family homes for sale with an average list price of $943,333.33. The homes range in size from 1,336 ft2 to 2,907 ft2. The HOA fees range from $46 to $140 per month. The average annual property tax for Ocotillo Lakes is $3,080.64. It is located in Maricopa County. |

|

Ocotillo LandingOcotillo Landing is a single-family home community in Chandler, Arizona, built between 2015 and 2016. It currently has no homes for sale. The homes range in size from 2,482 ft2 to 3,901 ft2. The HOA fees range from $110 to $110 per month. The average annual property tax for Ocotillo Landing is $2,955.77. It is located in Maricopa County. |

868,000 | |

Old Stone RanchOld Stone Ranch is a single-family home community in Chandler, Arizona, built between 2005 and 2024 by Lennar. It currently has 4 single family homes for sale with an average list price of $932,125. The homes range in size from 1,722 ft2 to 4,846 ft2. The HOA fees range from $82 to $278 per month. The average annual property tax for Old Stone Ranch is $2,809.91. It is located in Maricopa County. |

830,000 | |

Orchard HeightsOrchard Heights is a single-family home community in Chandler, Arizona, built between 2019 and 2020. It currently has 1 single family home for sale with a list price of $899,000. The homes range in size from 2,126 ft2 to 2,562 ft2. The HOA fees range from $163 to $254 per month. The average annual property tax for Orchard Heights is $2,777.38. It is located in Maricopa County. |

777,500 | |

Paseo CrossingPaseo Crossing is a single-family home community in Chandler, Arizona, built between 2001 and 2003. It currently has 1 single family home for sale with a list price of $650,000. The homes range in size from 1,913 ft2 to 3,881 ft2. The HOA fees range from $103 to $132 per month. The average annual property tax for Paseo Crossing is $2,943. It is located in Maricopa County. |

669,000 | |

Paseo TrailPaseo Trail is a single-family home community in Chandler, Arizona, built between 2003 and 2005. It currently has 2 single family homes for sale with an average list price of $809,993.50. The homes range in size from 1,919 ft2 to 3,917 ft2. The HOA fees range from $66 to $92 per month. The average annual property tax for Paseo Trail is $2,956.79. It is located in Maricopa County. |

||

Pecos AldeaPecos Aldea is a single-family home community in Chandler, Arizona, built between 1996 and 1998. It currently has 2 single family homes for sale with an average list price of $436,999.50. The homes range in size from 1,118 ft2 to 1,694 ft2. The HOA fees range from $42 to $49 per month. The average annual property tax for Pecos Aldea is $1,496.29. It is located in Maricopa County. |

385,000 | |

Pegasus AirparkPegasus Airpark is a single-family home community in Queen Creek, Arizona, built between 2002 and 2025. It currently has 9 single family homes for sale with an average list price of $3,415,102.22 and 2 lots for sale with an average list price of $995,000. The homes range in size from 2,637 ft2 to 16,109 ft2. The HOA fees range from $86 to $195 per month. The average annual property tax for Pegasus Airpark is $4,274.52. It is located in Maricopa County. |

||

PescaraPescara is a single-family home community in Chandler, Arizona, built between 2018 and 2019. It currently has 2 single family homes for sale with an average list price of $1,156,500. The homes range in size from 2,919 ft2 to 3,909 ft2. The HOA fees range from $185 to $195 per month. The average annual property tax for Pescara is $3,586.63. It is located in Maricopa County. |

1,062,500 | |

Peterson FarmsPeterson Farms is a single-family home community in Chandler, Arizona, built between 2003 and 2004. It currently has 3 single family homes for sale with an average list price of $633,000. The homes range in size from 1,689 ft2 to 3,778 ft2. The HOA fees range from $62 to $100 per month. The average annual property tax for Peterson Farms is $2,607.87. It is located in Maricopa County. |

||

Pinelake EstatesPinelake Estates is a single-family home community in Chandler, Arizona, built between 2003 and 2005. It currently has 1 single family home for sale with a list price of $949,900. The homes range in size from 2,326 ft2 to 5,490 ft2. The HOA fees range from $104 to $164 per month. The average annual property tax for Pinelake Estates is $4,824.84. It is located in Maricopa County. |

942,500 | |

Pinelake VillagePinelake Village is a single-family home community in Chandler, Arizona, built between 2004 and 2005. It currently has 1 single family home for sale with a list price of $525,000. The homes range in size from 1,261 ft2 to 1,982 ft2. The HOA fees range from $120 to $147 per month. The average annual property tax for Pinelake Village is $1,478.50. It is located in Maricopa County. |

438,000 | |

PontevedraPontevedra is a single-family home community in Chandler, Arizona, built between 2007 and 2011. It currently has no homes for sale. The homes range in size from 2,621 ft2 to 3,901 ft2. The HOA fees range from $211 to $235 per month. The average annual property tax for Pontevedra is $4,828.91. It is located in Maricopa County. |

1,005,500 | |

Quail SpringsQuail Springs is a single-family home community in Chandler, Arizona, built between 2006 and 2011. It currently has 3 single family homes for sale with an average list price of $754,633.33. The homes range in size from 1,809 ft2 to 3,693 ft2. The HOA fees range from $120 to $130 per month. The average annual property tax for Quail Springs is $3,219.82. It is located in Maricopa County. |

649,000 | |

Redwood EstatesRedwood Estates is a single-family home community in Chandler, Arizona, built between 2004 and 2008. It currently has 9 single family homes for sale with an average list price of $690,765.22 and 1 lot for sale with a list price of $815,000. The homes range in size from 1,667 ft2 to 4,081 ft2. The HOA fees range from $55 to $106 per month. The average annual property tax for Redwood Estates is $2,596.41. It is located in Maricopa County. |

||

ReflectionsReflections is a single-family home community in Chandler, Arizona, built between 2001 and 2004. It currently has 2 single family homes for sale with an average list price of $387,000. The homes range in size from 1,162 ft2 to 2,370 ft2. The HOA fees range from $99 to $128 per month. The average annual property tax for Reflections is $1,326.32. It is located in Maricopa County. |

||

Reid's RanchReid's Ranch is a single-family home community in Chandler, Arizona, built between 2006 and 2010. It currently has 1 single family home for sale with a list price of $770,000. The homes range in size from 2,589 ft2 to 4,588 ft2. The HOA fees range from $95 to $120 per month. The average annual property tax for Reid's Ranch is $4,079.27. It is located in Maricopa County. |

787,500 | |

Reserve at Fulton RanchReserve at Fulton Ranch is a single-family home community in the Fulton Ranch neighborhood of Chandler, Arizona, built between 2013 and 2017. It currently has 1 single family home for sale with a list price of $699,000. The homes range in size from 1,595 ft2 to 2,723 ft2. The HOA fees range from $105 to $194 per month. The average annual property tax for Reserve at Fulton Ranch is $2,755.74. It is located in Maricopa County. |

604,500 | |

Riggs Country EstatesRiggs Country Estates is a single-family home community in Chandler, Arizona, built between 2004 and 2005. It currently has 3 single family homes for sale with an average list price of $1,041,666.67. The homes range in size from 3,405 ft2 to 5,699 ft2. The HOA fees range from $42 to $53 per month. The average annual property tax for Riggs Country Estates is $4,709.60. It is located in Maricopa County. |

1,129,250 | |

|

Riggs Ranch MeadowsRiggs Ranch Meadows is a single-family home community in Chandler, Arizona, built between 2001 and 2005. It currently has 5 single family homes for sale with an average list price of $850,980. The homes range in size from 2,221 ft2 to 4,678 ft2. The HOA fees range from $24 to $90 per month. The average annual property tax for Riggs Ranch Meadows is $3,129.23. It is located in Maricopa County. |

877,500 |

Rio Del VerdeRio Del Verde is a single-family home community in Chandler, Arizona, built between 2000 and 2001. It currently has 1 single family home for sale with a list price of $675,000. The homes range in size from 1,850 ft2 to 2,546 ft2. The HOA fees range from $47 to $70 per month. The average annual property tax for Rio Del Verde is $2,590.92. It is located in Maricopa County. |

||

Rockwood EstatesRockwood Estates is a single-family home community in Chandler, Arizona, built between 2001 and 2005. It currently has 2 single family homes for sale with an average list price of $739,950. The homes range in size from 2,203 ft2 to 4,541 ft2. The HOA fees range from $38 to $73 per month. The average annual property tax for Rockwood Estates is $3,485.76. It is located in Maricopa County. |

830,500 | |

Saguaro CanyonSaguaro Canyon is a single-family home community in Chandler, Arizona, built between 2002 and 2004. It currently has 7 single family homes for sale with an average list price of $711,957.14. The homes range in size from 1,365 ft2 to 4,314 ft2. The HOA fees range from $54 to $97 per month. The average annual property tax for Saguaro Canyon is $2,915.71. It is located in Maricopa County. |

580,000 | |

San SebastianSan Sebastian is a single-family home community in Chandler, Arizona, built between 2006 and 2010. It currently has no homes for sale. The homes range in size from 3,920 ft2 to 6,050 ft2. The HOA fees range from $211 to $225 per month. The average annual property tax for San Sebastian is $6,954.47. It is located in Maricopa County. |

1,716,500 | |

Santan VistaSantan Vista is a single-family home community in Chandler, Arizona, built between 2001 and 2021. It currently has 1 single family home for sale with a list price of $1,999,000. The homes range in size from 2,633 ft2 to 6,566 ft2. The HOA fees range from $145 to $196 per month. The average annual property tax for Santan Vista is $8,518.63. It is located in Maricopa County. |

1,400,000 | |

Santana RidgeJust a short distance away, residents can savor diverse dining options like the innovative craft beers at SanTan Brewing Company or fresh farm-to-table meals at The Perch Brewery. For things to do, the nearby Chandler Fashion Center offers upscale shopping and entertainment, while adventure seekers can explore the interactive exhibits at the Arizona Railway Museum or enjoy outdoor fun at Veterans Oasis Park with its fishing lake and wildlife viewing. Essential health services are conveniently accessible, including comprehensive care at Chandler Regional Medical Center for routine check-ups or emergencies. Santana Ridge is a condo community in Chandler, Arizona, built between 2006 and 2016. It currently has 10 condos for sale with an average list price of $377,100. The homes range in size from 954 ft2 to 1,247 ft2. The HOA fees range from $185 to $275 per month. The average annual property tax for Santana Ridge is $1,275.54. It is located in Maricopa County. |

||

Scottsdale Estates TenScottsdale Estates Ten is a single-family home community in Scottsdale, Arizona, built between 1960 and 2014. It currently has 6 single family homes for sale with an average list price of $677,966.50. The homes range in size from 990 ft2 to 2,418 ft2. The average annual property tax for Scottsdale Estates Ten is $1,365.31. It is located in Maricopa County. |

||

Shadow RidgeShadow Ridge is a single-family home community in Chandler, Arizona, built between 2004 and 2005. It currently has 3 single family homes for sale with an average list price of $888,000. The homes range in size from 2,345 ft2 to 4,962 ft2. The HOA fees range from $85 to $109 per month. The average annual property tax for Shadow Ridge is $3,126.14. It is located in Maricopa County. |

745,000 | |

Sienna HeightsSienna Heights is a single-family home community in Chandler, Arizona, built between 1999 and 2006. It currently has 1 single family home for sale with a list price of $642,000. The homes range in size from 1,598 ft2 to 3,394 ft2. The HOA fees range from $49 to $103 per month. The average annual property tax for Sienna Heights is $2,447.29. It is located in Maricopa County. |

||

|

Solera ChandlerSolera Chandler is an active adult 55+ single-family home community in Chandler, Arizona, built between 2001 and 2018. It currently has 32 single family homes for sale with an average list price of $475,238.75. The homes range in size from 1,067 ft2 to 2,508 ft2. The HOA fees range from $111 to $177 per month. The average annual property tax for Solera Chandler is $2,339. It is located in Maricopa County. |

485,000 |

Southshore VillageSouthshore Village is a single-family home community in Chandler, Arizona, built between 2014 and 2016 by D.R. Horton. It currently has no homes for sale. The homes range in size from 1,837 ft2 to 3,806 ft2. The HOA fees range from $96 to $115 per month. The average annual property tax for Southshore Village is $2,927.85. It is located in Maricopa County. |

740,000 | |

SpringfieldSpringfield is an active adult 55+ single-family home community in Chandler, Arizona, built between 1997 and 2026. It currently has 18 single family homes for sale with an average list price of $460,481. The homes range in size from 878 ft2 to 3,615 ft2. The HOA fees range from $89 to $229 per month. The average annual property tax for Springfield is $1,827.49. It is located in Maricopa County. |

380,000 | |

|

Springfield LakesSpringfield Lakes is a single-family home community in Chandler, Arizona, built between 2001 and 2003. It currently has 3 single family homes for sale with an average list price of $581,633.33. The homes range in size from 1,525 ft2 to 3,113 ft2. The HOA fees range from $50 to $75 per month. The average annual property tax for Springfield Lakes is $2,289.40. It is located in Maricopa County. |

549,950 |

Sun GrovesSun Groves is a single-family home community in Chandler, Arizona, built between 2002 and 2010. It currently has 8 single family homes for sale with an average list price of $572,487.38. The homes range in size from 1,512 ft2 to 4,330 ft2. The HOA fees range from $34 to $175 per month. The average annual property tax for Sun Groves is $2,151.44. It is located in Maricopa County. |

539,500 | |

|

Sun Lakes Country ClubSun Lakes Country Club is a single-family home community in Sun Lakes, Arizona, built between 1975 and 2003. It currently has 30 single family homes for sale with an average list price of $395,199.97. The homes range in size from 970 ft2 to 2,531 ft2. The HOA fees range from $12 to $154 per month. The average annual property tax for Sun Lakes Country Club is $1,847.59. It is located in Maricopa County. |

|

|

Sun RiverSun River is a single-family home community in Chandler, Arizona, built between 2001 and 2005. It currently has 3 single family homes for sale with an average list price of $666,633.33. The homes range in size from 1,686 ft2 to 5,095 ft2. The HOA fees range from $72 to $111 per month. The average annual property tax for Sun River is $2,866.03. It is located in Maricopa County. |

685,000 |

SunBirdSunBird is an active adult 55+ single-family home community in Chandler, Arizona, built between 1987 and 1998. It currently has 31 single family homes for sale with an average list price of $356,877.07. The homes range in size from 880 ft2 to 2,250 ft2. The HOA fees range from $56 to $217 per month. The average annual property tax for SunBird is $1,533.99. It is located in Maricopa County. |

330,000 | |

SunridgeSunridge is a single-family home community in Chandler, Arizona, built between 1980 and 1983. It currently has no homes for sale. The homes range in size from 1,212 ft2 to 2,102 ft2. The average annual property tax for Sunridge is $1,387.63. It is located in Maricopa County. |

||

Sunrise Meadows EstatesSunrise Meadows Estates is a single-family home community in Chandler, Arizona, built between 2004 and 2006. It currently has 1 single family home for sale with a list price of $1,275,000. The homes range in size from 3,480 ft2 to 6,409 ft2. The HOA fees range from $150 to $220 per month. The average annual property tax for Sunrise Meadows Estates is $5,905.50. It is located in Maricopa County. |

1,362,500 | |

Symphony at Chandler HeightsSymphony at Chandler Heights is a single-family home community in Chandler, Arizona, built between 1999 and 2002. It currently has 1 single family home for sale with a list price of $959,990. The homes range in size from 2,791 ft2 to 5,390 ft2. The HOA fees range from $68 to $143 per month. The average annual property tax for Symphony at Chandler Heights is $3,658.44. It is located in Maricopa County. |

778,500 | |

The Landing at Reid's RanchThe Landing at Reid's Ranch is a single-family home community in Chandler, Arizona, built between 2008 and 2013. It currently has no homes for sale. The homes range in size from 3,829 ft2 to 5,639 ft2. The HOA fees range from $228 to $263 per month. The average annual property tax for The Landing at Reid's Ranch is $6,744.33. It is located in Maricopa County. |

1,880,000 | |

The Residences at BelmonteThe Residences at Belmonte is a single-family home community in Chandler, Arizona, built between 2015 and 2016. It currently has no homes for sale. The homes range in size from 2,286 ft2 to 3,541 ft2. The HOA fees range from $135 to $155 per month. The average annual property tax for The Residences at Belmonte is $2,978.38. It is located in Maricopa County. |

826,500 | |

The Willows at Power RanchThe Willows at Power Ranch is a single-family home community in the Power Ranch neighborhood of Gilbert, Arizona, built between 2006 and 2010. It currently has 6 single family homes for sale with an average list price of $465,316.67. The homes range in size from 1,294 ft2 to 4,593 ft2. The HOA fees range from $52 to $181 per month. The average annual property tax for The Willows at Power Ranch is $2,098.51. It is located in Maricopa County. |

||

Tierra LindaTierra Linda is a single-family home community in Chandler, Arizona, built between 2002 and 2006. It currently has 2 single family homes for sale with an average list price of $1,762,500. The homes range in size from 3,232 ft2 to 5,755 ft2. The HOA fees range from $120 to $170 per month. The average annual property tax for Tierra Linda is $8,025.18. It is located in Maricopa County. |

1,517,500 | |

TreelandTreeland is a single-family home community in Chandler, Arizona, built between 2023 and 2025. It currently has 1 single family home for sale with a list price of $960,000. The homes range in size from 2,427 ft2 to 3,341 ft2. The HOA fees range from $150 to $172 per month. The average annual property tax for Treeland is $881.38. It is located in Maricopa County. |

873,500 | |

Vaquero RanchVaquero Ranch is a single-family home community in Chandler, Arizona, built between 2013 and 2016. It currently has 3 single family homes for sale with an average list price of $784,933.33. The homes range in size from 1,980 ft2 to 3,828 ft2. The HOA fees range from $85 to $86 per month. The average annual property tax for Vaquero Ranch is $2,961.60. It is located in Maricopa County. |

820,000 | |

VasaroVasaro is a single-family home community in Chandler, Arizona, built between 2004 and 2026. It currently has 8 single family homes for sale with an average list price of $2,053,987.50. The homes range in size from 4,110 ft2 to 6,992 ft2. The HOA fees range from $218 to $277 per month. The average annual property tax for Vasaro is $7,079.36. It is located in Maricopa County. |

2,112,500 | |

Victoria ManorVictoria Manor is a single-family home community in Chandler, Arizona, built between 2007 and 2014. It currently has 1 single family home for sale with a list price of $849,900. The homes range in size from 3,401 ft2 to 4,393 ft2. The HOA fees range from $116 to $147 per month. The average annual property tax for Victoria Manor is $3,606.67. It is located in Maricopa County. |

960,000 | |

Villa del LagoVilla del Lago is a single-family home community in Chandler, Arizona, built between 2014 and 2017. It currently has 3 single family homes for sale with an average list price of $761,300. The homes range in size from 1,664 ft2 to 2,614 ft2. The HOA fees range from $155 to $200 per month. The average annual property tax for Villa del Lago is $2,416.71. It is located in Maricopa County. |

||

Vina SolanaVina Solana is a single-family home community in Chandler, Arizona, built between 2006 and 2012. It currently has no homes for sale. The homes range in size from 3,616 ft2 to 4,101 ft2. The HOA fees range from $150 to $180 per month. The average annual property tax for Vina Solana is $5,475.33. It is located in Maricopa County. |

1,287,500 | |

ViviendoViviendo, a boutique gated community, offers an elegant living experience. Residents enjoy a variety of amenities just steps from their front doors, including a dog park, green space, playground, and ramada, perfect for fostering a vibrant community atmosphere. Located near Ocotillo and McQueen Roads, Viviendo provides convenient access to major commuter routes like Loop 101, Loop 202, and Route 60, as well as proximity to shopping, dining, and outdoor recreation at destinations like Chandler Fashion Center and Veterans Oasis Park. Viviendo is a single-family home community in Chandler, Arizona, built between 2025 and 2026 by K. Hovnanian Homes. It currently has 11 single family homes for sale with an average list price of $802,293.64. The homes range in size from 2,147 ft2 to 3,397 ft2. The HOA fees range from $150 to $150 per month. The average annual property tax for Viviendo is $985.50. It is located in Maricopa County. |

765,430 | |

Whispering HeightsWhispering Heights is a single-family home community in Chandler, Arizona, built between 2006 and 2012. It currently has 1 single family home for sale with a list price of $749,950. The homes range in size from 2,337 ft2 to 4,067 ft2. The HOA fees range from $107 to $133 per month. The average annual property tax for Whispering Heights is $3,527.71. It is located in Maricopa County. |

905,000 | |

Whitewing at KruegerWhitewing at Krueger is a single-family home community in Chandler, Arizona, built between 2004 and 2022. It currently has no homes for sale. The homes range in size from 4,053 ft2 to 5,071 ft2. The HOA fees range from $140 to $195 per month. The average annual property tax for Whitewing at Krueger is $6,876.70. It is located in Maricopa County. |

||

Wind Song EstatesWind Song Estates is a single-family home community in Chandler, Arizona, built between 1995 and 1997. It currently has no homes for sale. The homes range in size from 1,241 ft2 to 1,602 ft2. The HOA fees range from $52 to $60 per month. The average annual property tax for Wind Song Estates is $1,613. It is located in Maricopa County. |

||

Windermere RanchWindermere Ranch is a single-family home community in Chandler, Arizona, built between 2019 and 2021. It currently has 2 single family homes for sale with an average list price of $949,500. The homes range in size from 2,651 ft2 to 3,590 ft2. The HOA fees range from $129 to $154 per month. The average annual property tax for Windermere Ranch is $3,238.00. It is located in Maricopa County. |

971,380 |

We have helped over 8,000 families buy and sell homes!

HomesByMarco agents are experts in the area. If you're looking to buy or sell a home, give us a call today at 888-326-2726.